One of the best things about visiting a really good hotel is the concierge. They’re the first person you see. They know how everything works. They answer your questions, and fix problems and look after you. Well, that’s what Tinkerbell does with tax.

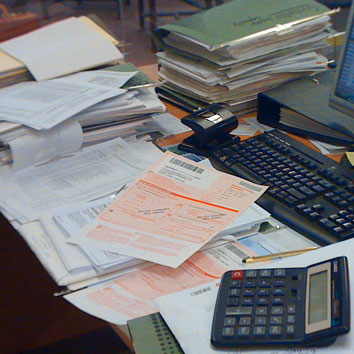

Rather than pay an accountant top rates to do all the preliminary work wading through boxes of paperwork, it makes more sense and saves money to get Tinkerbell to do that kind of stuff instead. Sometimes Tink will do your tax from start to finish. Other times she’ll handle all the laborious stuff so that top-notch accountant down the road is being paid only for the last stages of the tax process. But either way, it’s a great way to cut your costs.

From your first meeting, Tinkerbell will start sorting out your BAS or your tax. She’s a registered Tax Agent, which means she’s registered with the Australian Tax Practitioners’ Board and complies with the Tax Agent Services Act.

She collects documents, completes and lodges BAS, advises client payment details and returns the documents. And like any good concierge, she can liaise with the ATO regarding payment arrangements if required — let Tink be the go-between in your dealings with the ATO.

All the client has to do, is leave the folders of bank statements out for her. Clients also email her bank statements and credit card statements for completion and electronic lodgement of their BAS.

She collects kilos of paperwork from clients, sorts it into catagories and then provides year-end folders and spreadsheets for completion of the annual tax return for their individual, company or Self Managed Superfund accounts, by their accountant.

And Tink handles other things too, like for example dealing with the Office of State Revenue for issues related to Land Tax, and even helping clients locate their lost super or unclaimed money!

Home | About | Why Tinkerbell | Testimonials | FAQ | Contact